MOMMY TALKS PODCAST Episode 5

- MOMMY TALKS PODCAST

Are you a mom currently giving the government an interest-free loan of your hard-earned money each pay check? This article was designed to help you understand the history of taxes and provide you a basic understanding of tax laws. Which were designed for each and every one of us, believe it or not.

The Truth About Taxes and How to Make Them Work For You

Taxes are perhaps an employee’s single largest expense each month. The reality of paying taxes first hits you when you receive your very first pay check. It's at that moment that you realize you don’t get to keep everything you earn.

Mothers are being strongly advised to teach their children about money matters and financial literacy starting at a very young age. This it is not something that schools or colleges focus on in their curriculums. Someone I know once joked that the best way to teach your kids about taxes is by eating 30 percent of their ice-cream. It might sound cruel, but it’s accurate.

Tax laws were created for everyone and no one is above the law. However, some individuals learn of legal ways to avoid overpaying their taxes. In this article, I will teach you some techniques to increase your financial literacy and money management skills.

History of Taxes and Rise of Big Corporations

In the last century, the liberties that people fought so hard to achieve have slowly yet substantially eroded away as the government has unapologetically increased its share of your incomes. History tends to repeat itself and the same increase in taxes happened around 800 years ago. In the early 1200s, during the rule of King John of England, the people were extorted to pay tax rates as high as 50 percent.

In the year 1215, a civil war broke out and the rebels, led by Baron Robert Fitzwalter, a long-time rival of King John, gained control of London. With no options left, King John surrendered and in June of 1215, the Magna Carta (Great Charter) was signed. The Magna Carta afforded the rich and powerful barons and nobles various property rights, amongst other benefits.

In 1776, American colonists referred to the Magna Carta while demanding their liberty from the English Crown on the eve of the American Revolution. Its legacy can still be found in the Bill of Rights, the US Constitution, and the Fifth Amendment. “Nor shall any persons be deprived of life, liberty or property without due process of law”.

Fast forward to 1943 and the passing of the Current Tax Payment Act. This Act compels employers to withhold federal income taxes from workers' pay checks and pays them directly to the government on the workers' behalf. In other words, the government gets paid before the employee.

The Tax Reform Act was passed in 1986, negatively affecting the people primarily in tax quadrants “E” and “S” while hugely favoring people in quadrants “B” and “I”. Robert Kiyosaki defines these quadrants in his Rich Dad book series as:

- E — Employee – Anyone with a job.

- S — Self-Employed – Small business owners and self-employed professionals (Doctors, consultants, and lawyers).

- • B — Business Owner – This includes big businesses (500 and more employees). Businesses that are selling products and predefined services.

- I — Investor – People like Benjamin Graham, Warren Buffett, and Robert Kiyosaki himself.

Your goal should be to progress through the arrows and situate yourself on the right side of the table. This is where most rich people are making their wealth from. As you may already know, the rich and powerful have a significant influence over the government and its policies. Therefore, over the years, they have extracted huge tax benefits, incentives, and reliefs for themselves.

The rich make more money but pay less in taxes simply because they operate out of the B quadrant. Recently, many technology companies have been reported to have paid $0 in federal income taxes, including Amazon.

Doesn’t that just make your blood boil? Why should you, a hard-working mother, be paying a higher federal income tax than a multi trillion-dollar company like Amazon?

There are three main drivers for Amazon’s tax breaks:

- Employee Stock Compensation: Amazon has moved away from cash compensation to a stock-based compensation plan for its employees. As the stock of the company increases, so does the tax deductions coming from ownership of these Employee Stock Ownership Plans or ESOPs.

- Under current policy, companies can choose to fully deduct the expense of Research & Development. These are activities that companies undertake to innovate and introduce new products and services. It is often the first stage in the development process. The goal is typically to take new products and services to the market and add to the company’s bottom line. Amazon invests heavily in research and development. Hence it benefits from huge tax credits because these expenses are tax-deductible. In an article by Investopedia, they reportedly spent $23 billion in 2018.

- Deductions and incentives related to Property, Plant, and Equipment: The Tax Cuts and Jobs Act (TCJA), passed in December 2017 reduced the corporate tax rate from 35 percent to 25 percent. In addition, it gives significant tax incentives for business owners to invest in property, plant, and equipment, which is aimed to drive economic growth and job creation.

Your Income Tax Refund Check is Not Free Money Given to You

There is a reason why I place so much importance on financial literacy for you and your family. By learning to improve your financial literacy and legally stop giving the government an interest-free loan, you can change the standard of your family’s life. Not just for today but for generations to come thereafter.

If you got a tax refund last year, this means that you overpaid your taxes. I remember when I first started working, someone told me that you should claim nine for six months then zero for the next six months. Not understanding this, I simply did as I was told.

Because truth be told, most taxpayers look at receiving a tax refund as a bonus or a small lottery. Let me assure you it is not. In actuality, what the W4 form asks for is the amount of exemptions you are allowed based on your current situation. By not being aware of the exact amount of exemptions you can claim, you aren’t being taxed appropriately. I know I certainly wasn't.

So by overpaying in taxes for the year, the government is merely returning the interest-free loan that you loaned them throughout the year. Which they have invested and earned up to an eight to ten percent return on. In most cases, overpaying your taxes is avoidable. Increasing your financial literacy and knowing about the different tax deductions and tax credits can help you avoid overpaying your taxes in the future.

The W4 form was changed earlier this year. Now, you are no longer required to enter a number. Instead, you take about ten minutes to answer a few questions, which configures the amount you will owe in taxes for the year. The form is only being updated for new employees. So if you have not updated your W4 form this year, take a moment to figure out the amount you are required to pay for the year. You can update your form within your HR department. Update the form any time there are significant changes in your life.

How to Invest and Shelter Your Hard-Earned Money

Many people work their entire lives only to realize that when they are ready to retire, they don’t have enough saved up to live as comfortably as they had once imagined they would. This is due to inflation over the years. Everyone that I knew personally before my mentor has struggled all their lives, never fully attaining true financial independence. In Robert Kiyosaki’s book, Rich Dad, Poor Dad, he teaches us an important lesson to “pay yourself first”.

The idea is that when you earn money, the first thing you do is to pay yourself. You can do this by keeping ten percent of your earnings while spending the rest on your daily expenses. These are things like car insurance, phone expenses, internet subscription, kid’s college expenses, mortgage payment, taxes, etc. Once you have enough in savings, you will want to invest your money somewhere for it to grow and multiply.

But before investing your money, be sure that you understand the difference in the options that you have. You have the ability to invest your money in different ways. I will focus on the different types of IRAs. IRAs are individual retirement accounts that allow you to save money for your retirement in a tax-advantaged way. There is a traditional IRA and a Roth IRA or a 401k plan. A 401K is a qualified retirement plan that is sponsored by an employee’s employer that allows eligible employees of the company to save and invest toward their own retirement on a tax deferred basis.

A Roth IRA is a retirement savings account that allows your money to grow tax-free since you have already been taxed on the money before putting it in. You can withdraw contributions you made to your Roth IRA penalty-free at any time for any reason. Unless you are withdrawing any investment earnings before the age of 59 ½.

As of 2020, you can contribute up to $6,000 ($7,000 if you are 50 or older) tax-free per year. There is no limit on how many accounts you can establish, but the annual contribution limit remains the same for the total of all of your accounts. If you happen to invest more than the allowed contribution for the year, there is an imposed six percent tax per year on the excess amount as long as it remains in the account.

The biggest differences between a Roth and a traditional IRA is how and when you get a tax break on the money that has been invested. The tax advantage of investing in a traditional IRA is that your contributions are tax-deductible in the year in which they are made.

This means you are able to write off the monies on your taxes the year in which you make the investment. The tax advantage of a Roth IRA is that your withdrawals in retirement are not taxed. There are no income limits to contribute to a traditional, but when you reach a certain annual income ($139,000 for single, $206,000 if married and filing jointly), you are no longer able to contribute to a Roth IRA.

A 401k allows you to contribute about $19,500 ($26,000 if you are 50 or older) each year. Once you retire, you will be taxed on the withdrawals you make but at a much lower income tax rate than what you might be currently paying. It's completely up to you which option you choose. But it’s best that you understand the differences between them and make the best possible choice for you and your family. Because once you retire that is who is affected by the decision you make, or fail to make, today.

Improve your Financial Literacy and Attain Financial Freedom

Robert Kiyosaki says that your ultimate goal should be to move from the “E” quadrant of the cashflow quadrant to the “I” quadrant. He encourages everyone to develop an investor mindset, which is to learn how to get your money to make money for you. This is what the rich do as well. They know the power of compound interest and they let their money multiply itself.

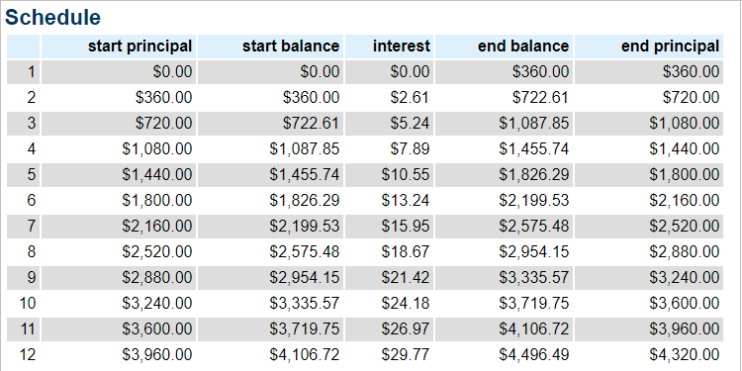

Let me demonstrate how compounding interest works and how overpaying your taxes will hinder your progress towards your financial goals. For example, let us take the $180 tax you may be currently paying each pay check, twice a month, for a total of $360 each month.

That's a total of $4,320 each year. If you were to invest the $360 each month at 8.7 percent, which is the rate that the IRS usually makes on your “interest-free loan” to them then you could receive a ROR (rate of return) of about $176.49 for the year by investing your own money. The table below shows this calculation.